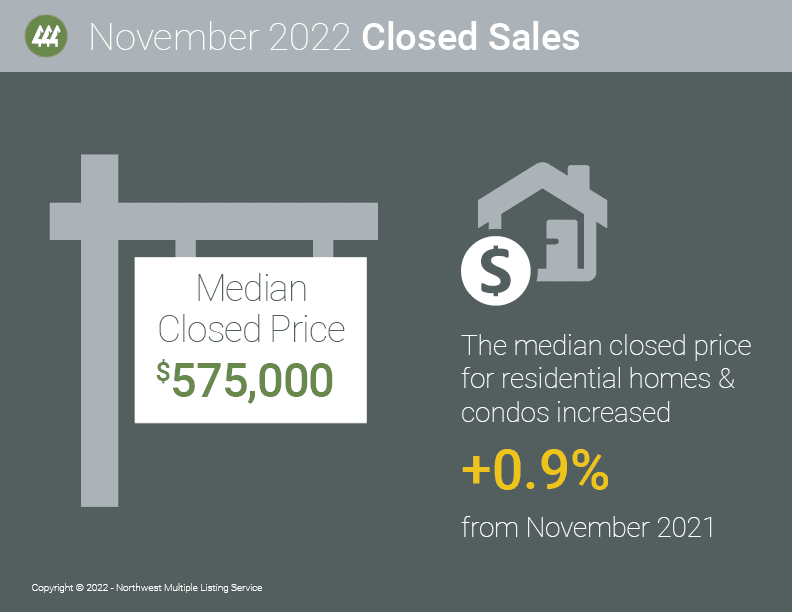

Prices on homes that sold during August rose 2.5% from a year ago, marking the first year-over-year (YOY) increase since January, according to a new report from Northwest Multiple Listing Service. The median price of $615,000 for 6,734 closed sales across 26 counties matched July’s figure.

For other key metrics on August activity, including new and active listings, pending sales, and closed sales, the YOY comparisons showed declines.

Brokers added 8,152 new listings of single family homes and condominiums last month, down from 9,914 for August 2022, a drop of nearly 17.8%. Last month’s systemwide tally of new listings was the smallest monthly total since April.

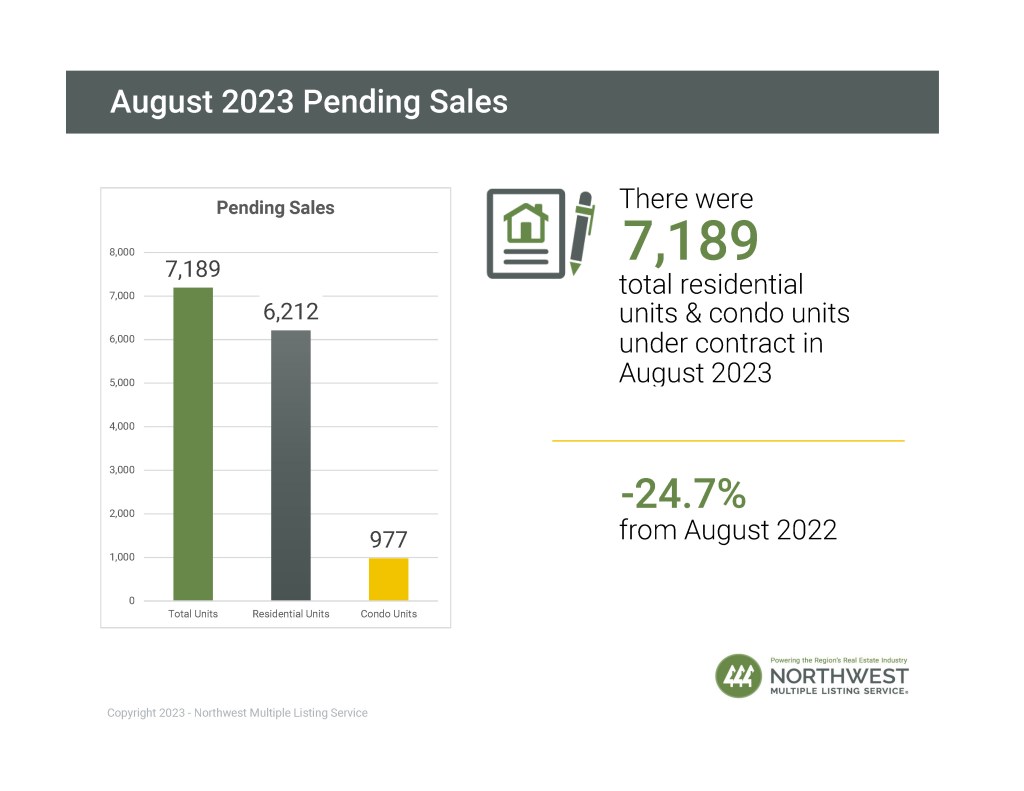

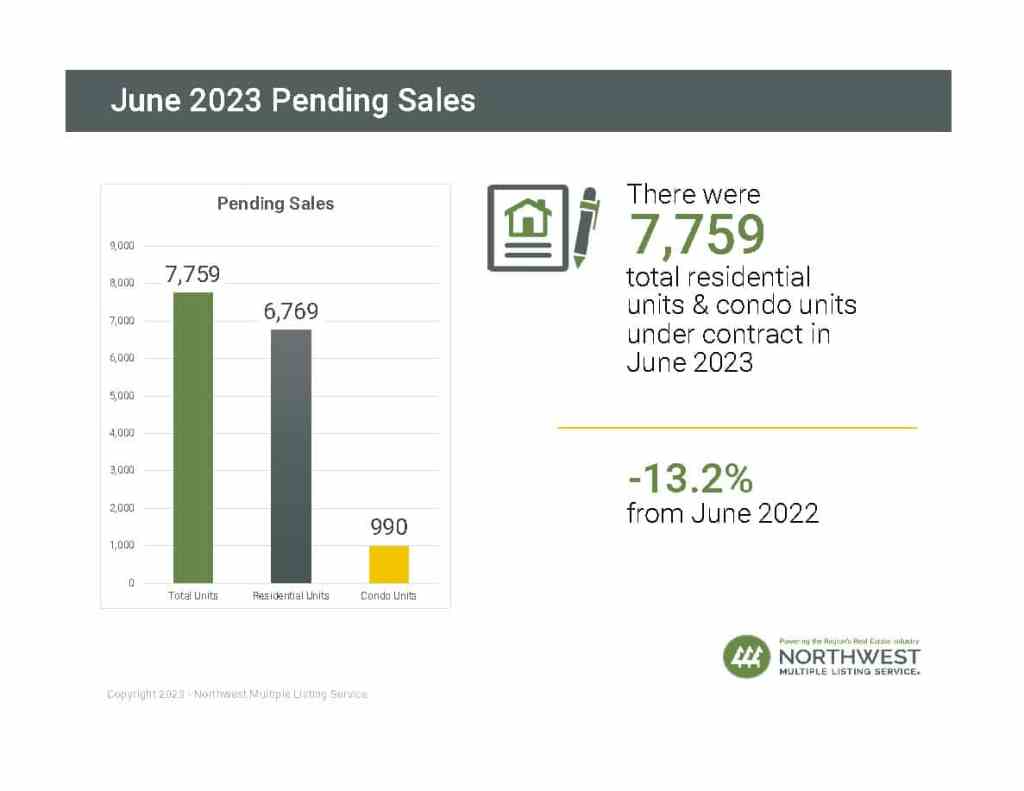

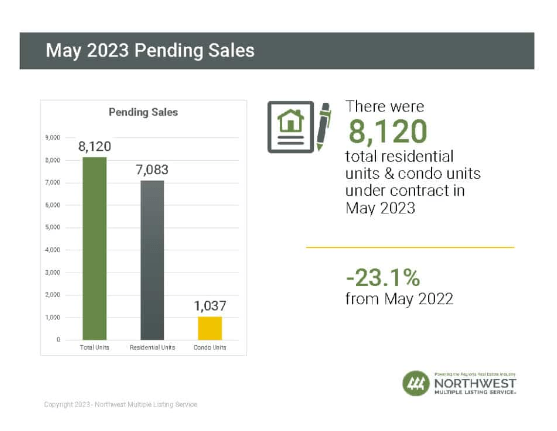

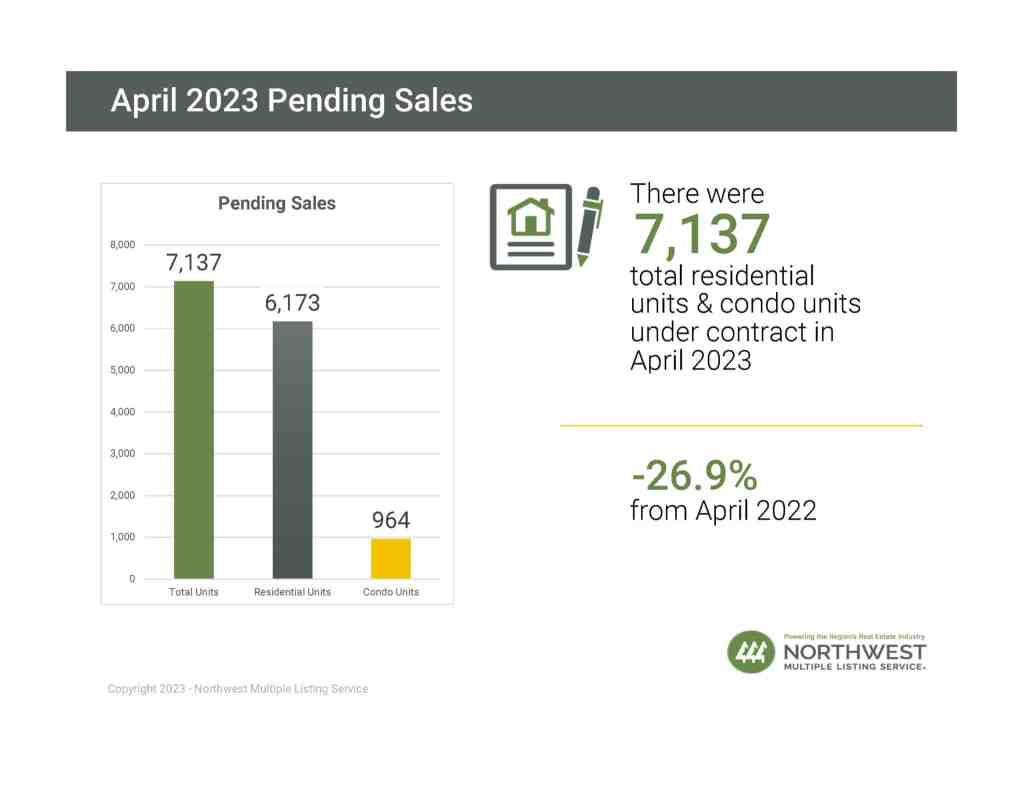

NWMLS members reported 7,189 pending sales during August, which was the lowest level since April’s total of 7,137, and down nearly 25% from the year ago figure of 9,552.

Brokers and other industry-watchers point to upticks in mortgage rates as the culprit for declining sales.

The average interest rate on a 30-year home loan reached 7.23% as of August 24, according to Freddie Mac. That is the highest rate since 2001, but it subsequently dropped to 7.12% for the week ending September 7. Along with forcing buyers to sit on the sidelines, the escalating rates are a deterrent to would-be sellers who bought or refinanced home in recent years and don’t want to swap their 3% rate for a 7% mortgage.

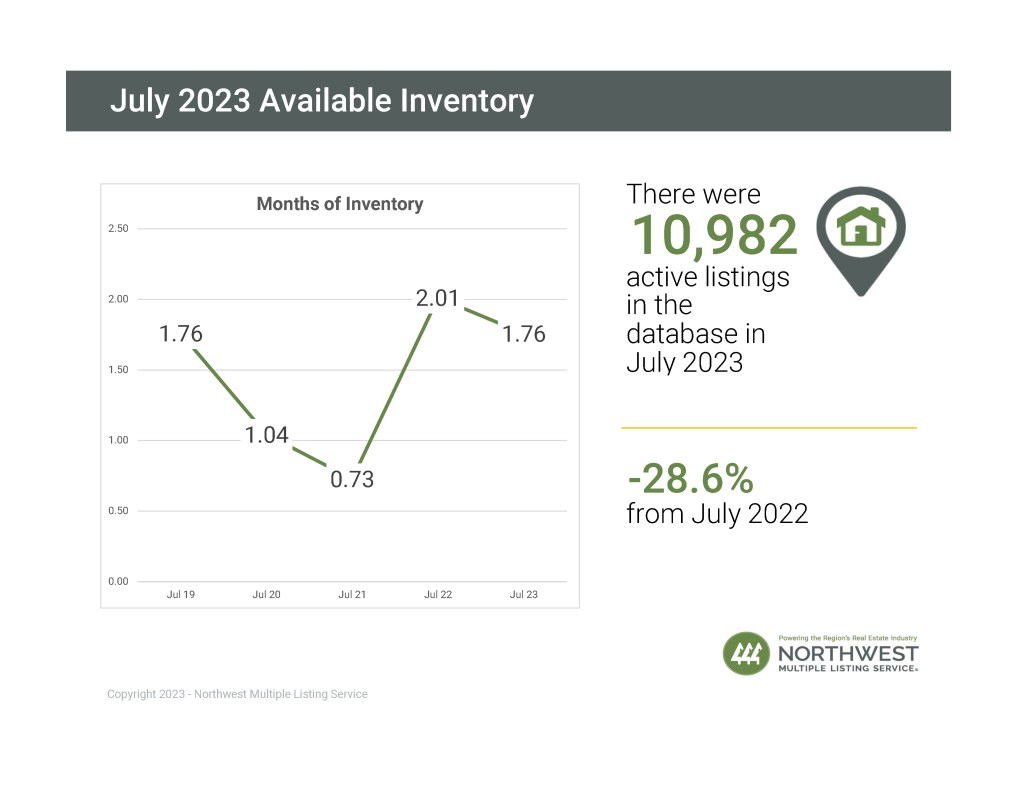

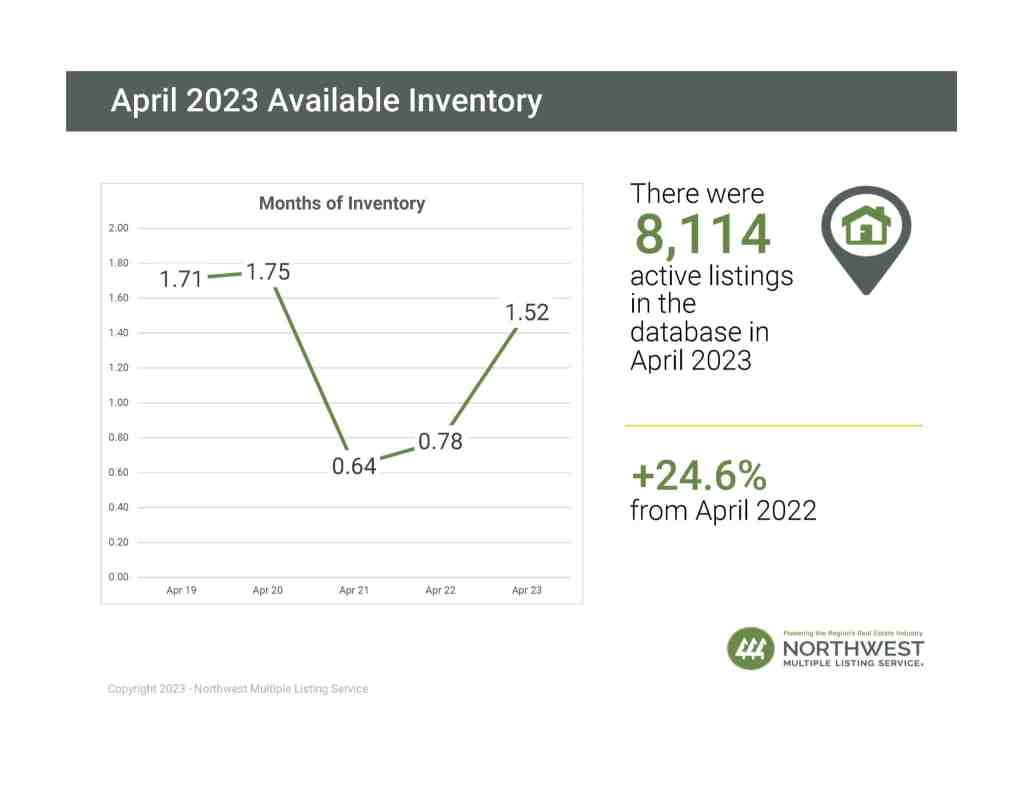

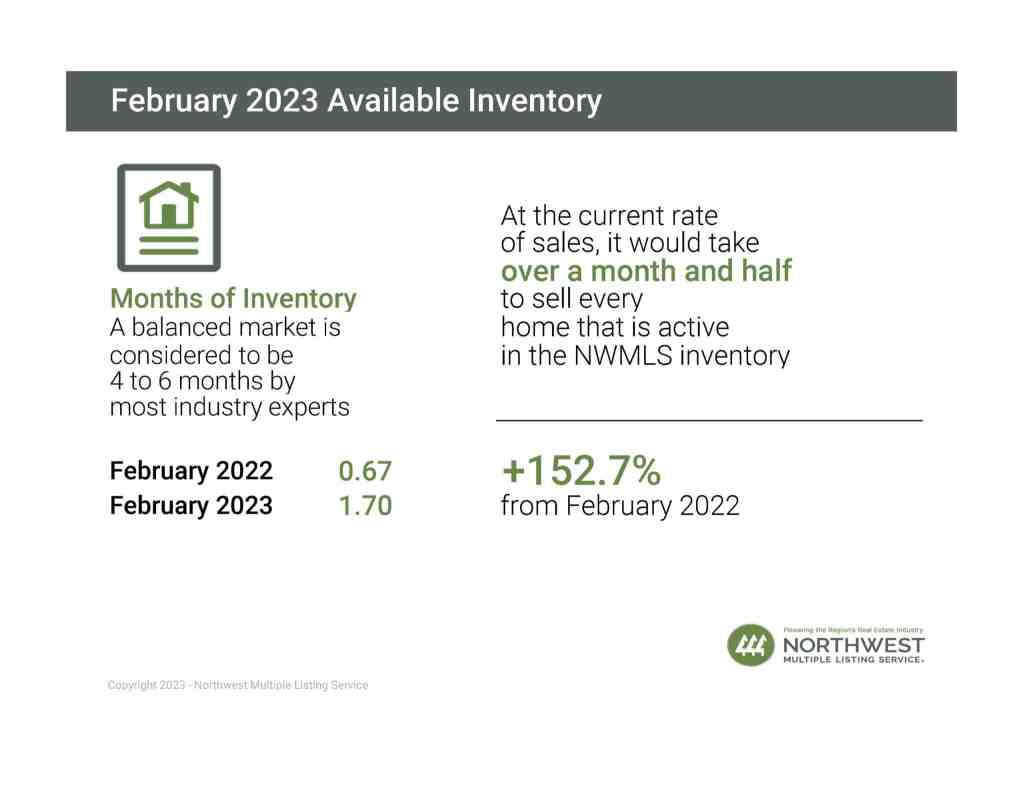

Despite slower activity, supply remained constrained with only 1.71 months of inventory in the MLS database. That’s down from both a year ago when there was 1.84 months of supply, and from last month when the figure was 1.76.

Contact me for more details, or watch the 1.25 minute market report video…

Source: NWMLS 9/8/2023