Home sellers:

Match the season when preparing your home to hit the market this fall

Leaves are falling. Temperatures are dropping. Daylight is dwindling. In other words, fall is officially here – and it’s a popular time for buying and selling homes.

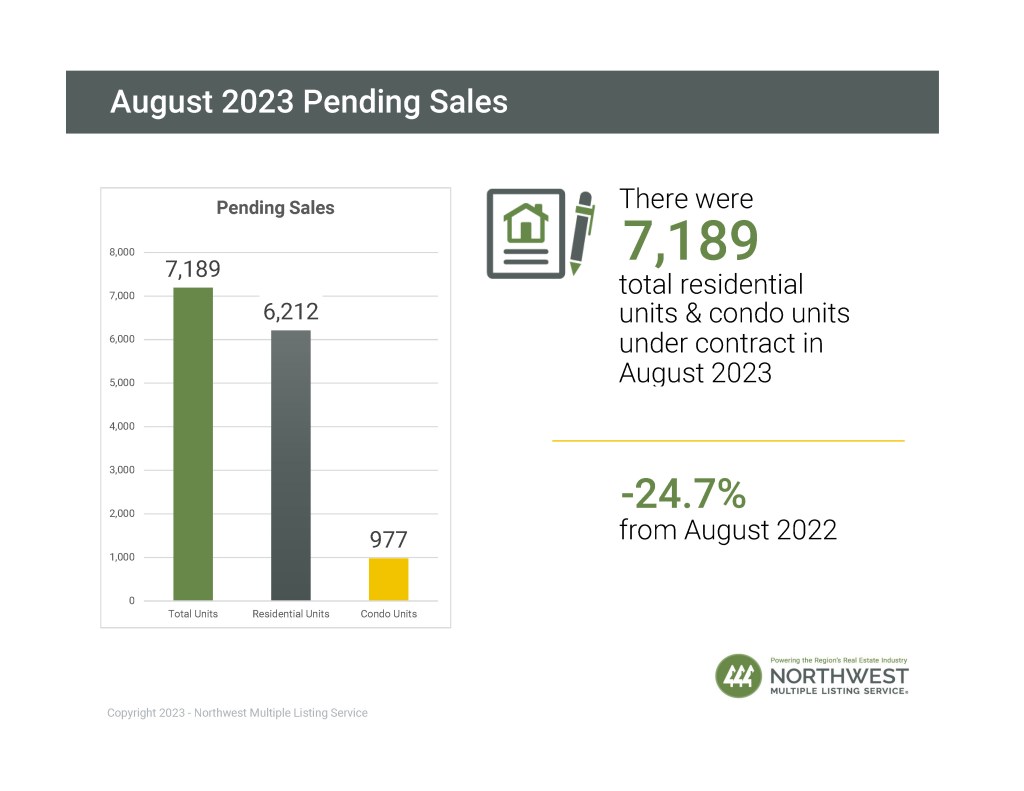

According to the latest RE/MAX National Housing Report, August 2023 home sales in 50 U.S. metro markets rose 7.4% from July – and the number of homes for sale increased 2.7% from July. These trends offer promise for a bustling autumn selling season.

Are you ready to sell a home this fall? Help your house match the season with these timely staging tips:

1. Make for a warm welcome outdoors

Online listings photos are often the hook that make buyers want to tour a home in-person. And when those buyers pull up to the home, their first impression starts with curb appeal. Make sure it’s a good one. Keep the lawn and shrubbery tidy, edge the walkway, pluck any remaining weeds, and rake fallen leaves for a tidy appearance.

From there, create an inviting entrance to your home with fall-themed items, including vibrant potted mums, pumpkins, a refreshed welcome mat, and even an autumn-inspired wreath on the door.

2. Implement seasonal scents

Scent evokes an emotional response, which can help buyers form a positive impression of your house. And from picking pumpkins to baking treats to sipping coffee to enjoying cool days in nature, the activities of fall include many ambient aromas that remind people of home. Some favorites include:

• Pumpkin spice

• Balsam fir, pine, or spruce

• Vanilla

• Cinnamon

• Apple

To bring the scents of fall inside your home when it’s for sale, consider using fragrant pinecones in a basket as statement décor, and searching for your favorite fall scents in the form of a reed diffuser, oil diffuser, or candle.

3. Don’t skimp on cozy textures

If a buyer purchases a home now, chances are they’ll be settled in time for the winter. This means that through staging, you’re able to suggest a comfortable scene for the chilliest and shortest days of the year.

To stage for the fall season and present your home as a place of rest, make simple swaps with inviting materials in a calming color palette. Try switching up accent pillows and throw blankets in the living room and linens in the bedrooms. Chunky knit blankets and boucle-textured pillows continue to be popular choices.

4. Add in autumnal décor

There are other simple ways to stage for the season, too. Give prospective buyers a peek at the possibilities for holiday gatherings by setting the table with placemats, plates, and a centerpiece that align with a classic fall color palette, which consists of warm, earthy hues.

Not only do dried florals offer a rustic look when displayed inside a vase, but they also have a much longer lifespan than fresh florals. And if your home has a wood burning fireplace, re-stock it with traditional logs – or birch – to lighten up the space.

Don’t forget: Natural lighting is an essential element in making sure your home puts its best foot forward during tours and open house events. Open the shades and curtains to let in as much light as possible.

Looking to sell your home this fall? Contact me today!