July Sales Down but Inventory is Up,

Sellers Get Their Asking Price

July marked the first month-over-month decline in home sales since April, signaling that perhaps the peak of summer buying is beginning to taper. Growth in the inventory of homes for sale inched up alongside modest increases in interest rates despite strong consumer demand.

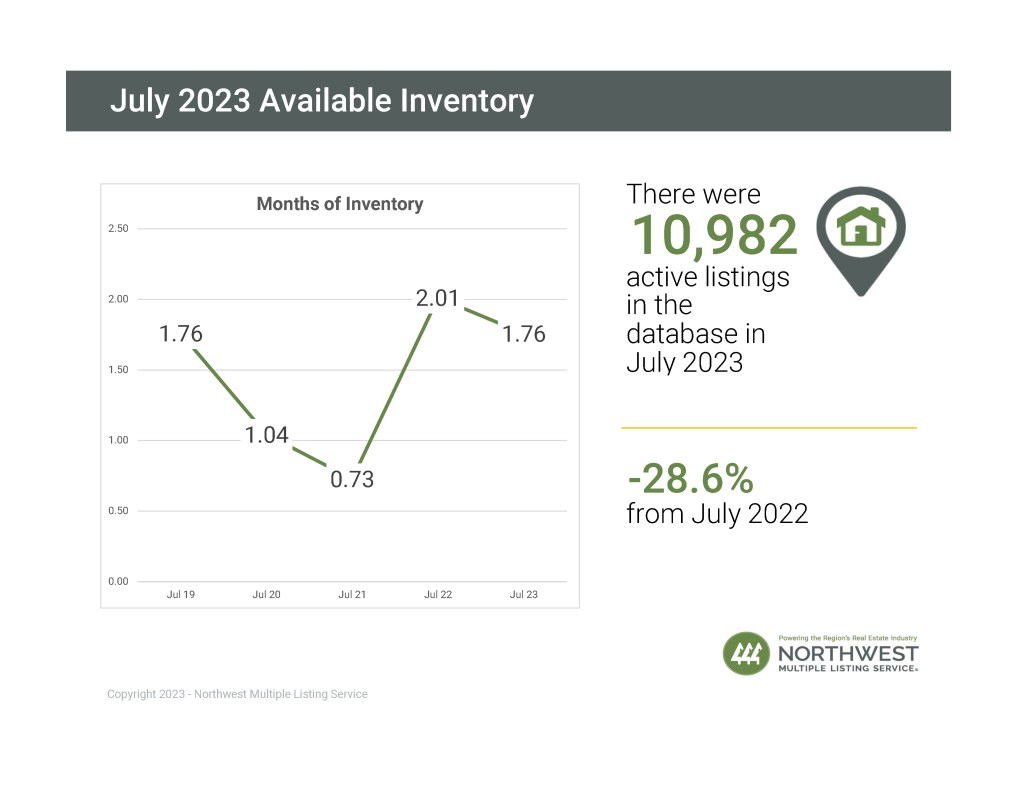

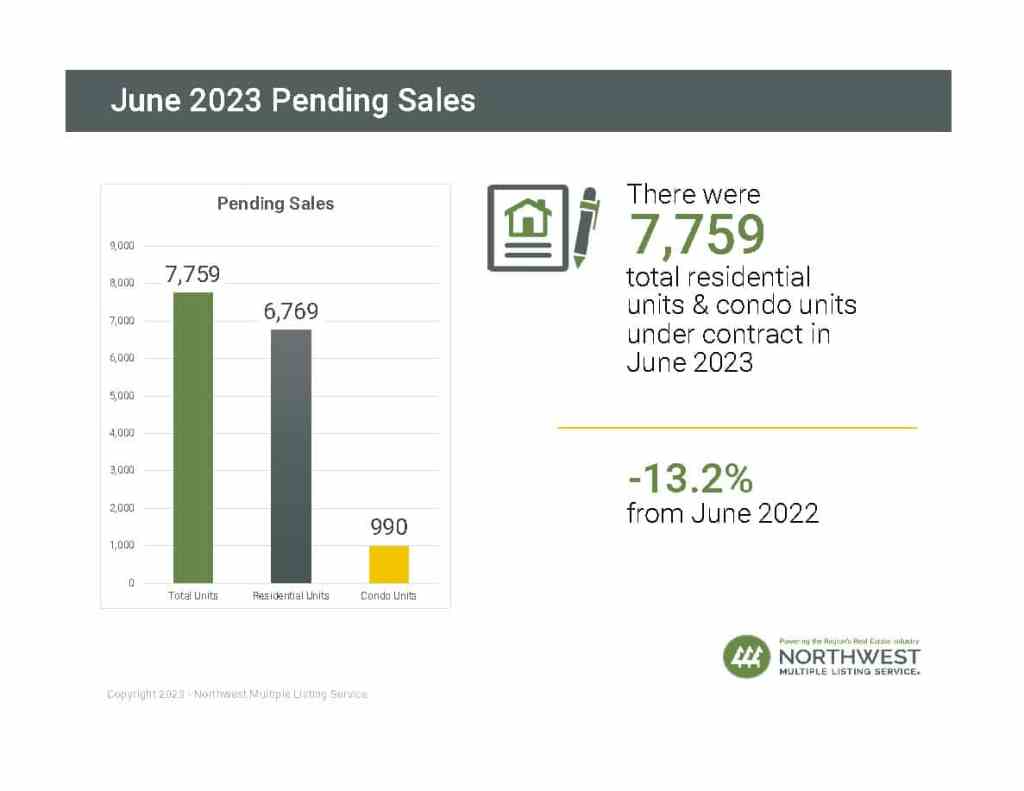

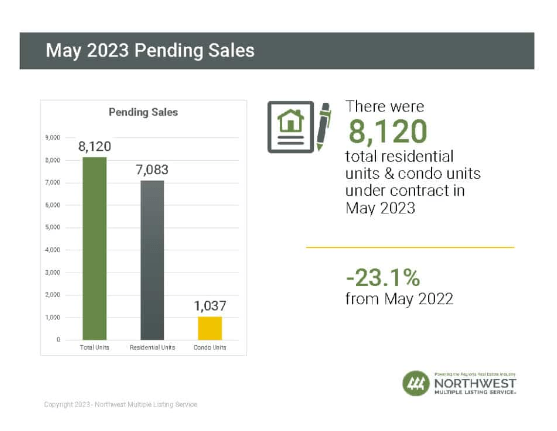

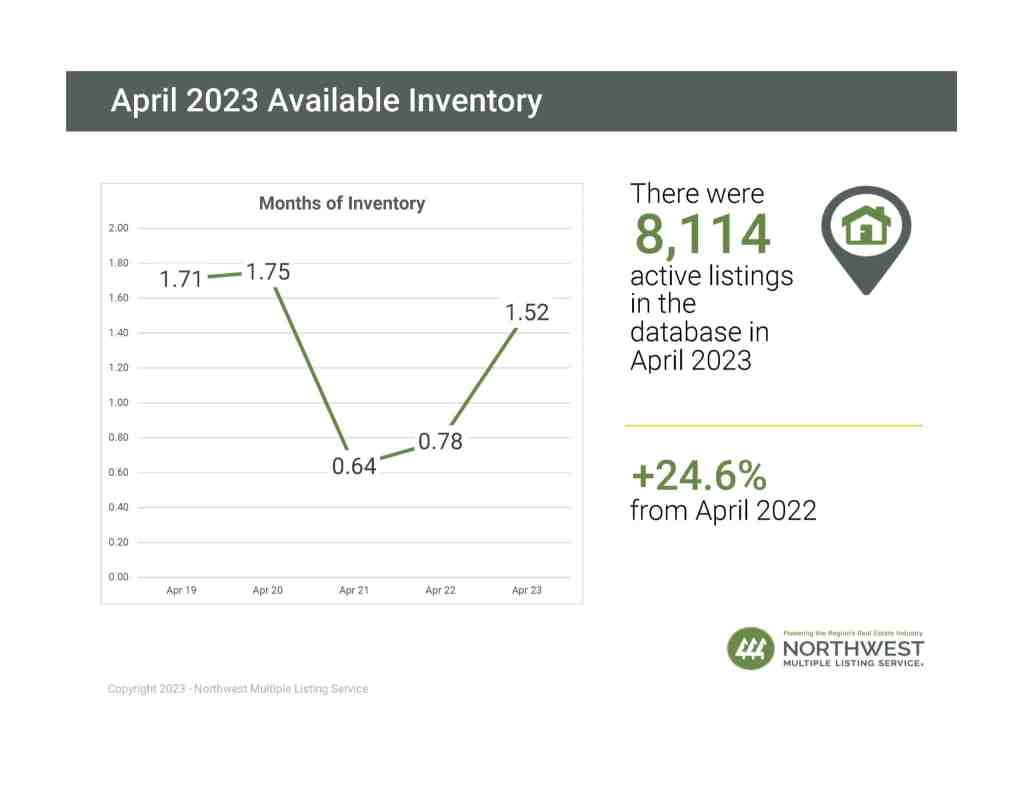

July home sales declined 14.7% from June and 16.1% compared to a year ago. The decline was tied to a 9.0% drop in new listings month over month and represented 26.7% fewer new listings year over year across the 50 metro areas surveyed. July inventory was up 3.1% from June, even though it still lagged 20.8% from July 2022. Tight inventory amid consistent demand continued to prop up the median sales price of $425,000. This is a marginal decline of less than 1% compared to June, while registering a 1.2% upswing in comparison to July 2022.

With the average close-to-list price ratio in July at 100%, sellers were able to get their asking price from buyers. That was the average close-to-list ratio in June as well but was a decline from the 101% ratio recorded a year ago.

Other notable metrics:

• Months’ supply of inventory in July was 1.5, up from June’s 1.3 but below the 1.6 months recorded a year ago.

• Homes sold in July were on the market for an average of 30 days, which was 1 day longer than in June and 6 days longer than July of last year.

Read the full article…

Watch the 32 second summary video…