Are you in the market for a house and worrying about whether it will be harder to get a mortgage after Jan. 10, when new federal rules kick in? Don’t fret. For most people the rules won’t make much difference. If the new rules do prevent you from landing a mortgage loan, it could be a sign that you aren’t financially ready for homeownership.

Tag Archives: mortgage

Shutdown Will Stall Home Loans for Thousands

Beginning this week, thousands of home buyers will be unable to get approvals for their mortgages because of the government shutdown, potentially undercutting the nation’s resurgent housing market.

Without paperwork from the Internal Revenue Service, the Social Security Administration and in many cases the Federal Housing Administration, banks and other mortgage lenders will be less willing to make loans, if they can make them at all. For instance, lenders rely on the IRS to confirm borrowers’ income and on Social Security to confirm their identity.

Every day that government offices remain shuttered will delay an ever-larger fraction of mortgage closings, industry leaders say, jeopardizing mortgage and interest-rate approvals and spooking sellers. About 15,000 new home mortgages and 18,000 refinancings on average are completed across the country each day.

As Mortgage Refi Boom Dries Up

…lenders are loosening requirements for homebuyers.

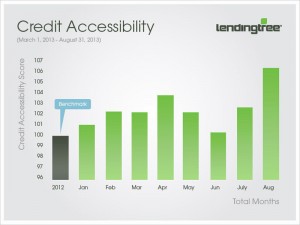

Online mortgage originator LendingTree’s monthly Credit Accessibility Report shows the average accessibility score for U.S. borrowers rose from 103 to 106 between July and August, indicating that borrowers had easier access to mortgage credit.

The Credit Accessibility score is benchmarked at 100, using data from the full year of 2012, which is where it stood in June.

Suze Orman Changes Homebuying Advice

Now that we are seeing a rebound in the housing market, it is time for a new home buying strategy says Suze Orman. “Financial advice needs to change according to what is happening in the economy,” she says.

In today’s economy, with interest rates still low, relatively speaking, and home prices leveling out, Orman says potential homebuyers no longer need to make a down payment of 20 percent. “I’m fine if you can get a mortgage with 10 percent down,” says Orman.

Alternative Ways to Come Up With the Down Payment on a Home

To successfully purchase a home today, you will need a down payment of at least 3.5 percent of the purchase price. Gone are the days of no down payment alternatives, down payment assistance and seller-offered programs to come up with the money needed to buy a home. Instead, let’s look at the five ways you can come up with a down payment to seal the deal.

Second Chance for Foreclosed Home Owners

The Federal Housing Administration is giving some former home owners another shot at home ownership. The FHA sent a letter to mortgage lenders stating that it would offer mortgage insurance to borrowers who once filed for bankruptcy, or who lost their homes through foreclosure or short sale during the recession.

Still, potential borrowers must show they can meet all other FHA requirements and that they are no longer financially constrained. Borrowers also will have to undergo housing counseling and FHA is requiring lenders to verify that at least a year has passed since the foreclosure or “economic event” that caused the foreclosure or bankruptcy.

All-Cash Deals on the Rise

As mortgage rates creep up and stringent lending standards continue to make it difficult for many home buyers to get loans, all-cash deals are accounting for more and more home sales completed in the U.S.

RealtyTrac data released recently shows that 40 percent of all home sales in July — including single-family homes, co-ops, condos and townhomes — were made without a loan being recorded, up from 35 percent in June and 31 percent in July 2012.

Banks May Ease Lending Standards Soon

With fewer home owners refinancing their mortgages because of rising interest rates, banks may soon relax their lending standards to ramp up business, according to the Mortgage Bankers Association.

Credit availability has risen 3 percent since May — when mortgage rates began to rise — according to an MBA survey. Refinances have fallen 59 percent from a year ago, but applications for home purchases have risen 5 percent.

In recent years, tight underwriting standards have been blamed on shutting out many people from the housing market. Many potential borrowers have been unable to meet requirements for higher credit scores and larger down payments in order to qualify for a loan.

Home Buyers Face Higher Closing Costs

Rising mortgage rates aren’t the only problem house hunters are facing. Closing costs for loan origination and other fees have increased 6 percent in the past year, according to a survey by Bankrate.com.

Borrowers with stellar credit who are making a 20 percent down payment are still forking over an average of $2,402 in closing costs on a $200,000 loan.

The President Moves on Housing Reform

With the great housing reform debate underway, the White House recently weighed in with President Obama’s plan for the future of housing finance in America. The President laid out a vision for housing finance, with key elements similar to those embraced by many stakeholders in the nation’s housing finance system. This is an issue that affects the well-being of every American, whether a homeowner or a renter, and we welcome the President’s attention and leadership.