Housing Inventory Continues to Increase This Fall

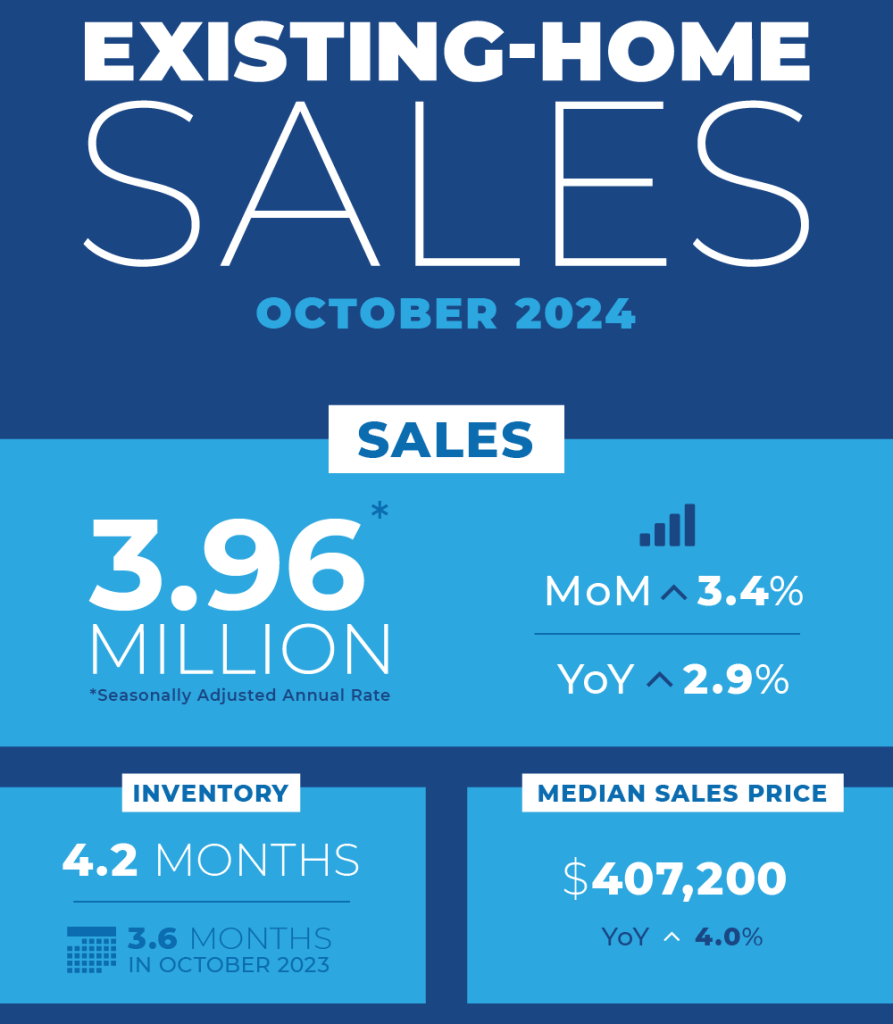

As fall progresses, housing inventory continues to grow across the U.S. – supported by an uptick in homes hitting the market.

The latest RE/MAX National Housing Report analyzed aggregated data from 52 markets – coast to coast – throughout September 2024. The countrywide intel revealed that new listings increased 9.7% from September 2023. It also revealed that housing inventory was up 6.4% from August 2024 and up a whopping 33.6% from September 2023.

The slowing of home sales is a partial reason for this growing quantity of available listings. Normal for the season, home sales in September dipped just over 13% from the previous month. In recent years, home sales similarly dipped from August to September, too.

Strong home prices in 2024 might be an intriguing factor for today’s sellers looking to make a move in the final quarter of the year. The RE/MAX report found the median sales price for September – $429,000 – was down just 1.4% from the month prior, but was up 4.6% from the year prior. September also marked the 15th consecutive month where the median sales price was higher year-over-year.

Read the full article…

Watch the 32 second summary video…