June Home Sales Tick Up Over May

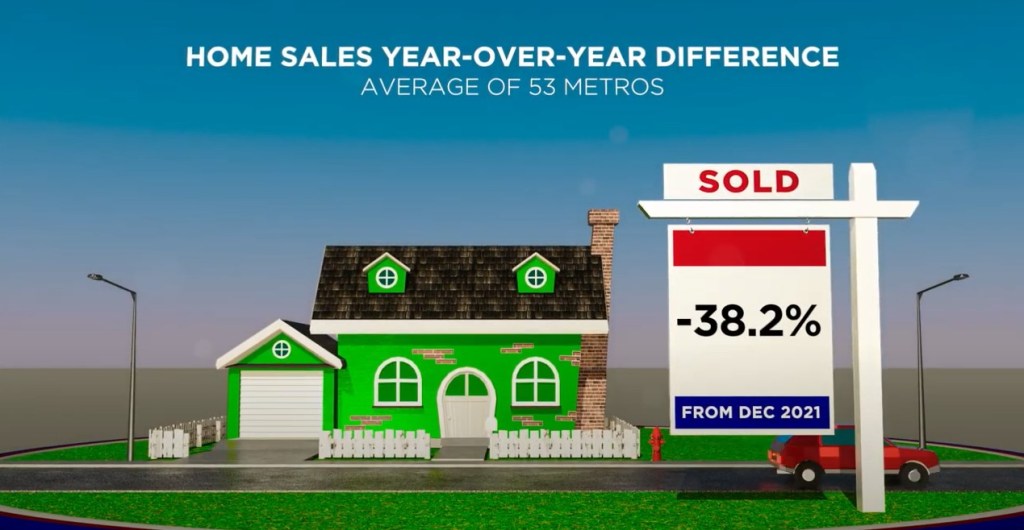

June posted month-over-month increases in home sales (up 5.4% from May) and inventory (up 7.2%) while year-over-year activity continued to trail the strong results of early 2022. June 2023 home sales were 18.7% below last June’s, contributing to a first-half 24% decline in closings compared to the first half of 2022 across the 52 metro areas surveyed in the RE/MAX National Housing Report.

June’s year-over-year decline in active inventory of 10.7% was the first such decrease in the past 13 months. New listings, although down 25% compared to a year ago, were up 0.5% over May.

Typically the biggest month for home sales, June produced a median sales price of $425,000 which was the highest since June 2022’s peak price of $426,000.

Other notable metrics:

• Months’ Supply of Inventory in June was 1.4, up from May’s 1.3 but below the 1.6 months recorded a year ago.

• The average close-to-list price ratio for June was 100%, indicating that homes sold for the asking price on average. This matched May’s ratio and was a decline from the 102% ratio recorded a year ago.

• Homes sold in June were on the market for an average of 31 days, which was the same in May but 9 days longer than June of last year.

Read the full article…

Watch the 32 second summary video…